Contents:

Tom-next rates are not determined by XM but are derived from the interest rate differential between the two currencies that a position was taken in. Positions held open overnight may be charged rollover interest. In the case of forex instruments, the amount credited or charged depends on both the position taken (i.e. long or short) and the rate differentials between the two currencies traded. In the case of stocks and stock indices, the amount credited or charged depends on whether a short or a long position has been taken. However, you may be able to roll the outstanding balance of your loan to your new employer’s plan.

There will be no https://forexanalytics.info/ tax withholdings, so your entire balance will be rolled over, and you’ll continue benefiting from the tax advantages. If you roll your money into an IRA, you will receive a Form 5498 and an account confirmation from the IRA trustee or custodian. If you roll your money into a new plan, ask your employer if you will receive confirmation. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Published since 1995, the 401k Averages Book is the oldest, most recognized resource book for non-biased, comparative 401 average cost information and 401k rollover to IRA recommendations. Broker Dealers and Registered Investment Advisors rely on 401k Averages Book data to populate parts of their 401k to IRA rollover recommendation and SEC’s Regulation Best Interest forms and disclosures. Maersk has previously tested a system of fines for no-shows and rollovers on containers booked online. In simple terms, a rollover occurs whenever your container cannot be loaded onto the ship that you booked. There’s no more capacity on board, so the container is postponed until the next available ship departs.

Do I have to leave my job to withdraw my retirement plan money?

If you reached age 70½ before this date, you are still required to take RMDs. If you roll over your distribution but don’t replace the withholding, the amount withheld will be considered a distribution subject to taxes and possible penalties. The content on this page provides general consumer information. This information may include links or references to third-party resources or content. We do not endorse the third-party or guarantee the accuracy of this third-party information. Rollover is basically switching from the front-month contract that is close to expiration to another contract in a further-out month i.e carrying forward of your futures positions.

If you’ve retired or changed jobs, you may have questions about whether to roll over your employer’s 401 retirement plan. Funding for education can come from any combination of options and a J.P. Morgan Advisor can help you understand the benefits and disadvantages of each one. Compare between 529 Plans, custodial accounts, financial aid and other education options to help meet your goals. Easily research, trade and manage your investments online all conveniently on chase.com and on the Chase Mobile® app. J.P Morgan online investing is the easy, smart and low-cost way to invest online.

What to Know About Rolling Over Retirement Accounts – The New York Times

What to Know About Rolling Over Retirement Accounts.

Posted: Fri, 08 Jul 2022 07:00:00 GMT [source]

This https://day-trading.info/ing over can be done anytime before the market closing on 22nd Feb 2018. Our Client Assistance Center is comprised of staff who are knowledgeable in HSA transfer and rollover and are eager to help you begin the process of easily consolidating your accounts with HSA Bank. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

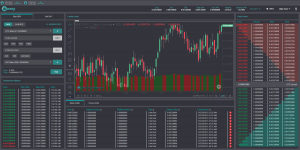

Trading Platforms

You should have received the applicable fee schedule with a welcome letter when the account was opened. You can obtain a copy of the fee schedule by contacting a Client Service Representative. If you take a lump-sum distribution and you were born before 1936, you may qualify for preferential tax treatment called 10-year forward averaging. This tax is payable for the year in which you receive the lump-sum distribution. Check with your plan’s contact to find out if rollovers are allowed and, if so, what type of contributions are accepted.

- If the interest rate on the trader’s short position is higher than the rate on the long position, then the trader pays the interest.

- They’re looking forward to a lifetime of fees and commissions and are willing to throw some cash your way as an enticement for your business.

- If you roll your money into a new plan, ask your employer if you will receive confirmation.

The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Or you buy 25m of the “8-week Treasury Auction” and select “Yes” for rollover (into 8-week auction). Four weeks later you buy 25m of the “4-week Treasury Auction,” which has the same CUSIP due to Treasury reoffering, and select “Yes” for rollover (into 4-week auction). You will now own 50m of the same Treasury CUSIP, and they will all be selected “Yes” for rollover.

CD rollover also allows you to set up a CD ladder, where each rung will roll over at maturity. Treasury investments will continue to roll over at each maturity date until you choose to change or cancel your instructions on Schwab.com. Treasury rollover is a convenient way of keeping your money invested.

Rollover Fees definition

In addition to the rollover fee, retail forex brokers will also usually charge a bid/offer spread on performing rollovers. As a result, they will generally pay you less to roll a long position on the higher interest rate currency in a currency pair than you will pay to roll a short position in the same currency pair. If you’re transferring your 401 to another broker and setting up any kind of tax-advantaged retirement account, there probably won’t be any fees. They’re looking forward to a lifetime of fees and commissions and are willing to throw some cash your way as an enticement for your business. If you change jobs, you may decide to move your retirement savings from your old workplace plan into your new employer’s plan, if your new employer allows it. Just like a rollover IRA, this option provides you with one account for all your retirement assets and you may have the ability to invest in plan-specific investment options.

However, transactions resulting from automatic reinvestment are subject to Schwab’s standard pricing schedule. For CDs, you have the option to keep the maturity term the same as it is for the CD you are buying or select a new maturity term for your investment to roll over at maturity. For example, you may be selecting a 6-month CD but would prefer that it roll over into a 3-month CD; in that scenario, you’d select a 3-month term. Treasuries, during the order entry process, select an eligible investment and then designate your investment by selecting “Yes” for Auto-Rollover. Once you agree to Schwab’s terms and conditions, mark your eligible investments to roll over at their maturity date. Trade your way with access to the world’s leading trading platforms, including MetaTrader 4 and MetaTrader 5 .

How to the Calculate Rollover Rate (Forex)

If you’re going to pay more, it’s probably not a good financial move. If you’re managing it on your own and purchasing stocks or other no-fee investment vehicles, the only fee you will pay is the transaction fee. If you put money into a mutual fund or other managed product, you will pay whatever fee is disclosed in the prospectus of that fund. For CDs, you may cancel before market close on the business day following your new order. If you wish to cancel your order to purchase this investment, please visit schwab.com/positions.

IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Do not anticipate and move without market confirmation—being a little late in your trade is your insurance that you are right or wrong. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. From basic trading terms to trading jargon, you can find the explanation for a long list of trading terms here.

Below are a few of the details to know when considering this transaction. A J.P.Morgan Private Client Advisor works with you to understand you and your family’s goals to help create a customized strategy to help you plan for tomorrow, today. To read more about charges applicable to different accounts, follow through to our trading costs. Rollover Feemeans the late fees applicable to you if you fail to make any payments due to DCL at the due date for such payment.

You can also keep your money in your former employer’s plan if allowed. If you choose the latter option, you can no longer add to the account balance. Yes, you can take a portion of your retirement plan balance in cash and either move the remaining balance to a new employer’s plan or roll to an IRA. However, the portion taken in cash will be subject to applicable taxes, and possible penalties. Check with your new employer to find out if the rollover will be accepted by the new plan.

Capitalize Review: How to find forgotten 401(k) accounts and roll them into an IRA – CNBC

Capitalize Review: How to find forgotten 401(k) accounts and roll them into an IRA.

Posted: Tue, 17 Jan 2023 08:00:00 GMT [source]

You hereby agree that your demo https://forexhistory.info/ information will be shared with such representatives allowed to take contact with you. You hereby waive the benefit of Swiss banking secrecy in this respect towards the above mentioned persons and entities. Confidentiality of your personal data will be ensured throughout the group, regardless of the location of specific group units.

How do I convert my Traditional IRA to a Roth IRA?

What this means is closing your position in the contract which is about to expire and opening a similar new position in a further-out month contract. Virtual Assistant is Fidelity’s automated natural language search engine to help you find information on the Fidelity.com site. As with any search engine, we ask that you not input personal or account information. Information that you input is not stored or reviewed for any purpose other than to provide search results. Responses provided by the virtual assistant are to help you navigate Fidelity.com and, as with any Internet search engine, you should review the results carefully. Fidelity does not guarantee accuracy of results or suitability of information provided.

Investopedia does not include all offers available in the marketplace. Subtracting the interest rate of the base currency from the interest rate of the quote currency. Marshall Hargrave is a stock analyst and writer with 10+ years of experience covering stocks and markets, as well as analyzing and valuing companies. For instance, if the currency pair is EUR/USD, EUR is the base currency and USD is the quote currency – meaning you would be buying the euro and selling the US dollar. Forex stands for “foreign exchange” and refers to the buying or selling of one currency in exchange for another. While it is called “foreign” exchange, this is just a relative term.